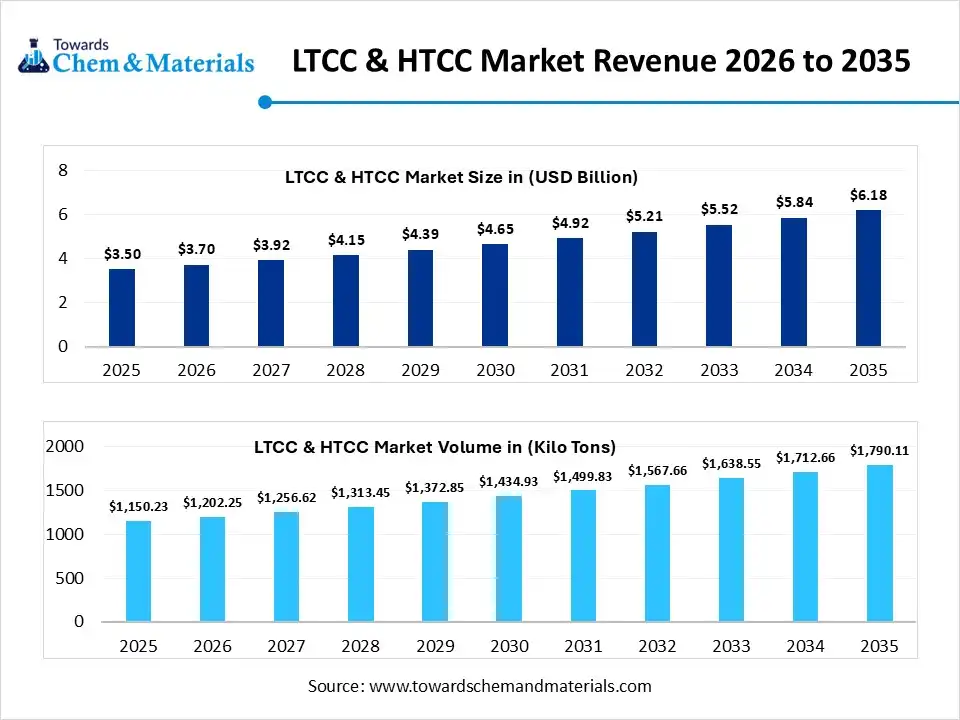

Ottawa, Feb. 21, 2026 (GLOBE NEWSWIRE) — The global LTCC and HTCC market size was estimated at USD 3.50 billion in 2025 and is expected to increase from USD 3.70 billion in 2026 to USD 6.18 billion by 2035, growing at a CAGR of 5.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,202.25 kilo tons in 2026 to 1,790.11 kilo tons by 2035. growing at a CAGR of 4.52% from 2026 to 2035. Asia Pacific dominated the LTCC and HTCC market with the largest volume share of 40.01% in 2025. The market is driven by sustainability, technological advancement, and demand in mission-critical and automotive electrification.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6193

LTCC and HTCC Market Report Highlights

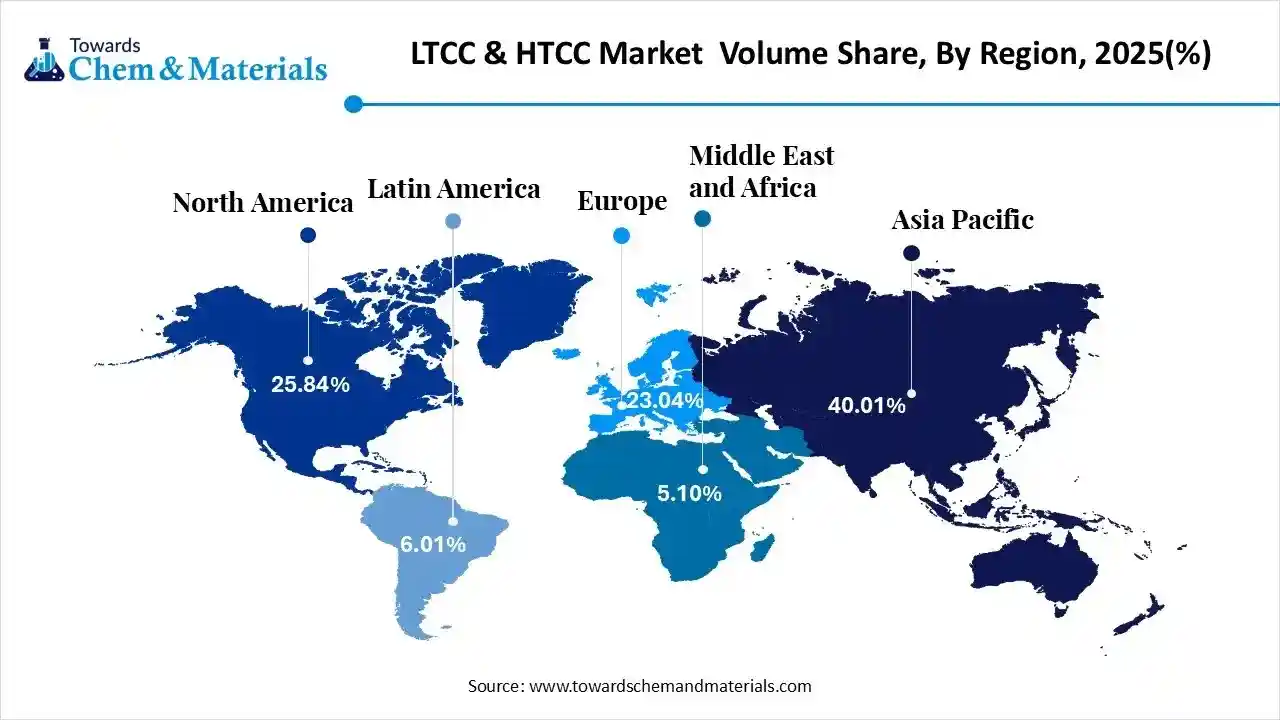

- The Asia Pacific dominated the LTCC and HTCC market with the largest volume share of 40.01% in 2025.

- The LTCC and HTCC market in North America is expected to grow at a substantial CAGR of 4.44% from 2026 to 2035.

- The Europe LTCC and HTCC market segment accounted for the major volume share of 23.04% in 2025.

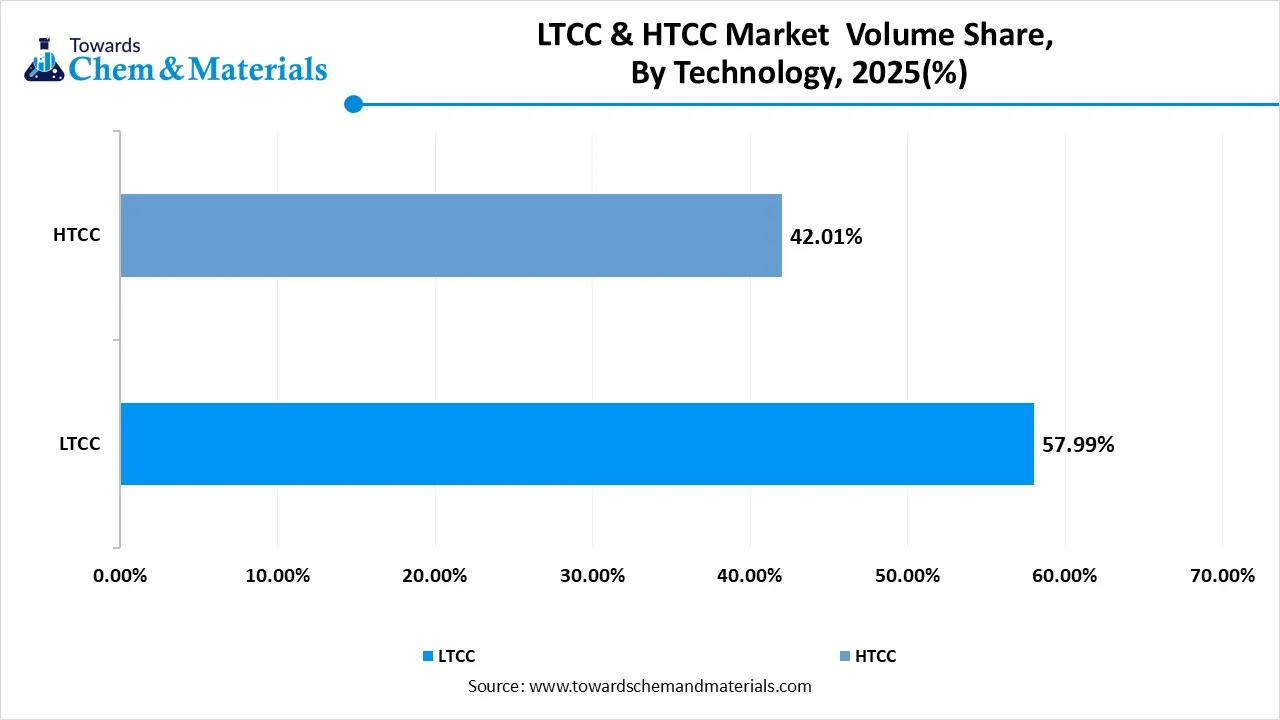

- By technology, the LTCC (Low Temperature Co-Fired Ceramic) segment dominated the market and accounted for the largest volume share of 58% in 2025.

- By technology, the HTCC (High Temperature Co-Fired Ceramic) segment is expected to grow at the fastest CAGR of 3.94% from 2026 to 2035 in terms of volume.

- By material type, the alumina (Al₂O₃) segment led the market with the largest revenue volume share of 55% in 2025.

- By end-user, the automotive electronics segment dominated the market and accounted for the largest volume share of 26% in 2025.

- By application, the RF & microwave module segment led the market with the largest revenue volume share of 30% in 2025.

- By manufacturing process, the tape casting & lamination segment dominated the market and accounted for the largest volume share of 45% in 2025.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3200) @ https://www.towardschemandmaterials.com/checkout/6193

What is the Significance of the LTCC and HTCC Industry?

LTCC and HTCC are high-performance ceramic technologies important to advanced electronic packaging. Its thermal thresholds and material compatibility make LTCC ideal for high-frequency, high-speed data transfer, co-fired with metals such as silver for miniaturization and signal integrity, especially in telecommunications and electronics. HTCC offers thermal stability, high reliability, toughness, and power handling, which is significant for aerospace and industrial applications. These technologies drive the shift toward three-dimensional integration in electronics, passive components, and hermetic protection into a robust ceramic platform.

Private Industry Investments for LTCC and HTCC:

- Kyocera Corporation: The company is expanding its Kagoshima Sendai Factory to increase production of large multilayer LTCC/HTCC packages for 5G communications and generative AI applications.

- Murata Manufacturing: Murata is investing in a new 3,500-square-meter facility in Chennai, India, dedicated to the packaging and shipping of multilayer ceramic capacitors to serve the growing electronics and EV markets.

- TDK Corporation: TDK signed a joint venture agreement with Nippon Chemical Industrial in late 2025 to accelerate the R&D of ceramic materials and manufacturing processes for multilayer components.

- NGK Spark Plug (Niterra): The group invested approximately 1.7 billion yen to double its production capacity in India, specifically for ceramic-based oxygen sensors and spark plugs.

- Vishay Intertechnology: Under its “Vishay 3.0” strategy, the company is allocating a portion of its $2.6 billion capital expenditure toward expanding capacity for ceramic passive components.

- SCHOTT AG: Through its partnership with VIA Electronics, SCHOTT provides specialized LTCC and HTCC hermetic packaging solutions for high-frequency aerospace and MEMS applications.

What Are Major Trends in the LTCC and HTCC Market?

- Focus on Sustainability: The rising focus on eco-friendly ceramic formulation and lead-free material to meet stringent environmental standards is shaping this trend and bolstering innovation.

- Integration of Additive Manufacturing: The transition towards a system-in-package solution within the multilayer ceramic substrate by integrating with 3D for the improvement of electrical performance and reducing device size.

- 5G and Emerging 6G Infrastructure: As a global shift towards 5G networks, offering low-dielectric loss and excellent thermal stability, is driving LTCC demand in RF module filters and antennas.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

LTCC And HTCC Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 3.70 Billion / 1202.25 KiloTons |

| Revenue forecast in 2035 | USD 6.18 Billion / 1790.11 KiloTons |

| Growth Rate | CAGR of 5.8% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2019 – 2025 |

| Forecast period | 2026 – 2035 |

| Quantitative units | Revenue in USD million and CAGR from 20265 to 2035 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Technology, By Material Type, By End-User, By Application, By Manufacturing Process, By Region |

| Regional scope | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Country scope | U.S., Canada, Mexico, China, India, Japan, Taiwan, Germany, UK, France, Italy, Spain, Benelux, Nordic, Poland |

| Key companies profiled | Hitachi Metals Ltd.; Kyocera Corporation; Murata Manufacturing Co., Ltd.; TDK Corporation; NGK Spark Plug Ltd.; Yokowo Co., Ltd.; KOA Corporation; Maruwa Co. Ltd. |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6193

What is Difference Between HTCC and LTCC?

Though HTCC and LTCC like a couple of co-twins, they still have some differences in some aspects.

1. Conductor material difference

In order to ensure high sintering density under low temperature co-fired conditions, amorphous glass, crystallized glass, and low melting point oxides are usually added to the components to promote sintering during the LTCC manufacturing. Glass-ceramic composite material is a typical low-temperature co-fired ceramic material. The conductors used are highly conductive materials (such as Ag, Cu, Au and alloys, such as AG-PD, AG-PT, AU-PT, etc.).

High temperature co-fired ceramic materials are mainly alumina, mullite and aluminum nitride ceramics, HTCC ceramic powder does not add glass material. And the conductor paste is made of tungsten, molybdenum, manganese and other high melting point paste.

| Ceramic PCB | Ceramic Substrate | Conductor | ||

| Material | Sinter Temp/C | Material | Melting Point/C | |

| LTCC PCB | Glass/Ceramic Composite

Crystal Glass Crystal Glass/Ceramic Composite Liquid-phase Sintered Ceramics |

900-1000 | Cu | 1083 |

| Au | 1063 | |||

| Ag | 960 | |||

| Ag-Pd | 960-1555 | |||

| Ag-Pt | 960-1186 | |||

| HTCC PCB | Alumina Ceramic

Mullite Aluminum Nitride |

1600-1800 | Mo | 2610 |

| W | 3410 | |||

| Mo-Mn | 1246-1500 | |||

2. Sinter temperature difference

The manufacturing processes of HTCC and LTCC are basically the same, we can call them a couple of co-twins. The typical process includes casting, cutting, punching, filling, printing, hot pressing, sinter and so on. Due to the selection of different materials to make the sintering temperature is different, HTCC is generally sintered at high temperature above 1500°C, and LTCC sintering temperature is generally below 1000°C.

3. Application difference

LTCC uses Au, Ag, Cu and other metals with high conductivity and low melting point as conductor materials. Due to glass ceramics have low dielectric constant and low loss performance at high frequency, makes LTCC a very suitable for application in RF, microwave and millimeter wave devices.

| Application | Specific Product |

| Module | Front-end Module |

| Receiving Module | |

| Automotive Power Control Module | |

| Package/Substrate | PA Module |

| Surface Wave Device Packaging | |

| SMD | BRF |

| LPF | |

| Coupler | |

| Duplexer | |

| Antenna |

However, because of the high sintering temperature of HTCC, it can't use gold, silver, copper and other low melting point metal materials like LTCC, must use tungsten, molybdenum, manganese and other refractory metal materials. This kind of materials features in low conductivity, will cause signal delay and other defects in some aspects. So, it is not suitable for high-speed or high-frequency micro-assembly circuit substrate. But HTCC substrate has the advantages of high structural strength, high thermal conductivity, good chemical stability and high wiring density, so it has a wide application prospect in high-power micro-assembled circuits. Below is a performance table of HTCC and LTCC.

| Item | HTCC | LTCC |

| Material | Alumina, AlN, Mullite | Crystaline Ceramics, Alumina, SiO |

| Sinter Temp | 1500-1800℃ | 850-900℃ |

| Conductor | W, Mn, Mo | Au, Ag, Cu, Pt |

| Thin Layer Resistance | 8-12mΩ/cm | 3-20mΩ/cm |

| Dielectrical Constant | 8-10 | 5-8 |

| Resistance | Not Available | 0.1Ω-1Ω |

| Sintering Shrinkage Rate (X,Y) | (12-18)% | (12.0+/-0.1)% |

| Sintering Shrinkage Rate (Z) | (12-18)% | (17.0+/-0.1)% |

| Line Width | 100um | 100um |

| TH Diameter | 125um | 125um |

| Metal Layer | 8 or 63 | 33 |

| Thermal Conductivity | 180-200W/m.k | 2-6W/m.k |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6193

LTCC and HTCC Market Dynamics

Driver

Automotive Electrification and Aerospace Demand

The growth is driven by a surge for HTCC in electric vehicle power modules, battery systems, and satellite communication due to its conductivity, while LTCC is utilized for advanced driver assistance systems and radar sensors due to its reliability, mechanical strength and thermal stability in mission guidance and demanding automotive environments.

Restraints

Manufacturing Complexity

This co-firing process is a multi-step process that needs simultaneous sintering of ceramic and conductive layers that demand highly skilled labour and rigorous quality control to avoid cracking, warping and delamination, that retraining the adoption and growth of the market.

Opportunity

Rising Innovation in Medical and Optoelectronics

The rising demand for the development of next-generation medical devices like implantable neurostimulators and miniature diagnostics sensors enables the opportunity for innovation in bioinert LTCC materials, while emerging 6G technology promotes the development of ceramic packages for high-speed optics.

Technology and AI

Technological shift and integration of AI are revolutionizing co-fired ceramics manufacturing with greater precision and efficiency. Machine learning optimizes ceramic compositions and sintering outlines for consistency. AI-driven optical inspection detects microscopic defects and improves yields. Predictive modelling simulates electromagnetic performance to accelerate the development of specialised substrates. This digital shift modernizes manufacturing and supports three-dimensionally integrated architectures for high-performance electronics.

LTCC and HTCC Market Segmentation Insights

Technology Insights

How Did the LTCC (Low Temperature Co-Fired Ceramics) Segment Dominate the LTCC and HTCC Market?

The LTCC (Low Temperature Co-Fired Ceramics) Segment dominated the market, enabling high-conductivity metals like silver and gold by offering signal integrity and minimal electrical loss in high- frequency circuits. Its ability to co-fire metals at lower temperatures enables dense, multilayered designs with embedded passive components, supporting miniaturization without sacrificing performance. Its thermal stability and coefficient with silicon ensure reliability and durability. This high-speed, compact, three-dimensional design enables its demand for telecommunications, automotive sensors, and high-performance modules.

The HTCC (High Temperature Co-Fired Ceramic) segment is anticipated to grow fastest, vital for high-reliability electronics due to its toughness and ability to resist extreme temperatures. Using refractory metals like tungsten and molybdenum, HTCC provides an uneven interconnection system with exceptional heat dissipation, thermal conductivity, and chemical resistance, crucial for housing high-power semiconductors. Its structural rigidity ensures stability and shock resistance, suitable for aerospace, industrial machinery, and high-voltage electronics.

LTCC & HTCC Market Volume and Share, By Technology, 2025-2035

| By Technology | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 | |||

| LTCC | 57.99 | % | 667.02 | 1105.75 | 5.78 | % | 61.77 | % |

| HTCC | 42.01 | % | 483.21 | 684.36 | 3.94 | % | 38.23 | % |

Material Type Insights

Which Material Type Segment Dominates the LTCC and HTCC Market?

The alumina (Al₂O₃) segment maintains its market dominance, offers a balance of electrical insulation, mechanical and thermal stability, with cost-effectiveness. Its chemical resistance and long-term durability suit harsh environments, enabling hermetic packages to protect electronics. Additionally, alumina dielectric properties and metallization compatibility support diverse industrial, electronic, automotive, and aerospace applications.

The glass-ceramic segment offers significant growth during the projected period, supporting high-frequency performance by allowing synchronized firing of ceramic and conductive metal traces. Its ability to have low-loss dielectric properties sustains signal quality in ultra- wideband applications. IT is an enabler of customizable thermal expansion that maintains structural integrity in multilayer stacks, enabling hermetically sealed, miniaturized modules that combine high-speed processing with environmental resilience in next-generation electronic infrastructure.

End-User Insights

How did the Automotive Electronics Segment Dominate the LTCC and HTCC Market?

The automotive electronics segment maintains its leadership in the market because it relies on co- fired ceramics for thermal resilience and toughness needed in vehicles. These materials package complex circuits into hermetic modules resistant to vibrations and temperature fluctuations in baking systems and engine compartments. It offers structural stability for power management, sensing, and high-frequency radar systems, ensuring reliability and signal purity in safety-critical vehicle systems and electrification.

The telecommunications segment is set to experience the fastest growth during the forecast period. This sector prefers co- fired ceramics for low dielectric loss and stability in high- frequency data transmission. They maintain signal integrity at millimetre- wave frequencies, enabling 3D integration of RF components within hermetic packages, and reducing hardware size by driving their demand in telecommunication infrastructure. Additionally, their high thermal conductivity manages heat from high- power transceivers, supporting performance and stability, essential for satellite communication and modern mobile networks.

Application Insights

Why did the RF and Microwave Modules Segment hold the Biggest Share in the LTCC and HTCC Market?

The RF and microwave modules segment dominates the market because this material offering electrical transparency, ultra- low loss, high-frequency precision,3D circuit stacking, and embedded passive components by maintaining signal integrity. They enable high-conductivity traces for nominal energy loss and superior power efficiency at millimetre waves. Additionally, their thermal stability and hermetic sealing prevent signal drift and environmental damage, making them ideal for radar, wireless systems, and satellite transceivers.

The power electronics modules segment is experiencing the fastest growth in the market during the projected period. Due to their thermal conductivity and dielectric strength, managing high power densities and high voltages. These substrates dissipate heat from wide-bandgap semiconductors, maintain efficiency, and reduce thermal stress by enabling the coefficient of thermal expansion with silicon and silicon carbide. Furthermore, their robustness, moisture resistance, and hermetic sealing make them suitable for EV inverters, motor drives, and renewable energy systems.

Manufacturing Process Insights

How did the Tape Casting Segment hold the Largest Share of the LTCC and HTCC Market?

The tape casting and lamination segment dominated the market, driven by high precision, enabling dense, multilayered designs with structural integrity. The process creates green sheets with controlled thickness and surface finish that are bonded under heat and pressure, creating hermetically sealed monoliths ideal for miniaturisation. This process supports high-density interconnections, ensuring reliability and dimensional stability in aerospace, telecommunication and automotive sensing.

The screen printing segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. It serves as an ideal method for depositing conductive, resistive, and dielectric pastes onto ceramic layers, providing precision and high throughput. It allows consistent trace widths and layer thicknesses, ensuring stable electrical performance and minimal signal attenuation. It is utilized in the application of large- area circuit patterns across ceramic sheets, reducing costs and enabling complex electrical architectures and production efficiency for telecommunications and automotive electronics.

Regional Insights

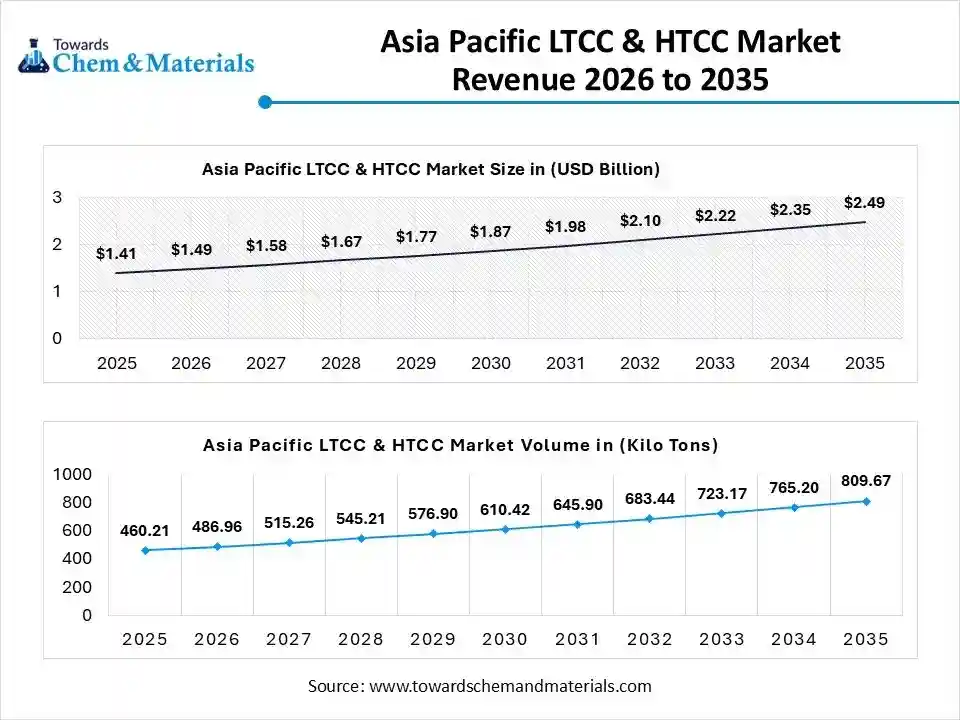

The Asia Pacific LTCC and HTCC market size was valued at USD 1.41 billion in 2025 and is expected to be worth around USD 2.49 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.86% over the forecast period from 2026 to 2035.

The Asia Pacific LTCC and HTCC volume was estimated at 460.21 kilo tons in 2025 and is projected to reach 809.67 kilo tons by 2035, growing at a CAGR of 6.48% from 2026 to 2035.Asia Pacific dominated the market with a 40% share in 2025.

Asia Pacific dominates the market due to its advanced manufacturing infrastructure and role in semiconductors and electronics, with a supply chain supporting multilayer ceramic fabrication. Its large-scale deployment of modern telecommunication and automotive sectors drives innovation and high-volume production of high-frequency, thermally stable modules. that positions them leader in technological advancement and global connectivity.

India LTCC and HTCC Market Trends

India's market is emerging as a growth segment within the broader electronics materials industry, propelled by expanding telecom infrastructure and electronics manufacturing, including the rollout of 5G networks and IoT devices that require high-performance ceramic substrates.

LTCC & HTCC Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 | |||

| North America | 25.84 | % | 297.22 | 439.47 | 4.44 | % | 24.55 | % |

| Europe | 23.04 | % | 265.01 | 360.17 | 3.47 | % | 20.12 | % |

| Asia Pacific | 40.01 | % | 460.21 | 809.67 | 6.48 | % | 45.23 | % |

| South America | 6.01 | % | 69.13 | 99.35 | 4.11 | % | 5.55 | % |

| Middle East & Africa | 5.10 | % | 58.66 | 81.45 | 3.71 | % | 4.55 | % |

North America's Growing LTCC and HTCC Industry

North America is vital for its strict regulatory framework and technological innovation, especially in aerospace and defense, demanding high thermal stability and ruggedness for radar, satellite, and guidance systems. Collaboration between research and industry sustains breakthroughs in material science and next-generation wireless connectivity, enhancing power efficiency and environmental resilience. This focus ensures North America remains a groundbreaker in robust ceramic packaging solutions.

U.S. LTCC and HTCC Market Trends

The U.S. market is experiencing steady growth driven by increasing demand from telecommunications, automotive, aerospace, and industrial electronics sectors. Expansion of 5G infrastructure and high-frequency RF applications is significantly boosting the adoption of LTCC substrates due to their superior electrical performance and miniaturization capabilities.

More Insights in Towards Chemical and Materials:

- Carbon Disulfide Market Size to Hit USD 285.79 Million by 2035

- Green Methanol Market Size to Hit USD 115.33 Billion by 2035

- Liquid Adhesives Market Size to Hit USD 70.52 Billion by 2035

- Biochemical Market Size to Surpass USD 244.11 Billion by 2035

- Biocomposites Market Size to Hit USD 254.99 Billion by 2035

- Recycled Polyester Market Size to Hit USD 42.11 Billion by 2035

- Polymers Market Size to Hit USD 1,424.98Billion by 2035

- Advanced Ceramics Market Size to Surpass USD 172.18 Bn by 2035

- Alpha Olefin Market Size to Surpass USD 21.16 Billion by 2035

- Amorphous Polyethylene Terephthalate Market Size to Hit USD 120.82 Bn by 2035

Key LTCC And HTCC Company Insights

Key companies in the global LTCC and HTCC industry include Hitachi Metals Ltd., Kyocera Corporation, and others. These companies adopt various strategies to enhance their competitive edge, including new product launches, mergers, and strategic partnerships. By focusing on innovative product development, they aim to meet the evolving needs of diverse industries. In addition, collaborations and agreements with other firms help expand their market reach and technological capabilities. Furthermore, mergers and acquisitions are employed to consolidate resources, streamline operations, and enhance overall market presence, ensuring sustained growth in a competitive landscape.

- TDK Corporation specializes in the manufacturing of electronic components and materials. The company produces a wide range of products, including filters, antennas, and RF components that utilize LTCC technology for high-frequency applications. TDK operates primarily in the electronics segment, focusing on telecommunications, automotive, and industrial applications.

- NGK Spark Plug Ltd. manufactures various products, including spark plugs, sensors, and ceramic substrates that leverage HTCC technology for high-performance applications. NGK operates predominantly in the automotive and industrial segments, providing advanced solutions that enhance vehicle performance and reliability.

Key LTCC And HTCC Companies:

The following are the leading companies in the LTCC and HTCC market. These companies collectively hold the largest market share and dictate industry trends.

Market Top Key Companies:

- Hitachi Metals Ltd.

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- NGK Spark Plug Ltd.

- Yokowo Co., Ltd.

- KOA Corporation

- Maruwa Co. Ltd.

Recent Developments

- In February 2025, Kyocera announced it is developing an AI-powered 5G virtualised base station using NVIDIA's GH200 platform for telecommunication infrastructure. The innovative solution focuses on enhancing connectivity performance, functionality, and reducing operational power consumption.

LTCC and HTCC Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Powder Coatings Market

By Technology

- LTCC (Low Temperature Co-Fired Ceramics)

- HTCC (High Temperature Co-Fired Ceramics)

By Material Type

- Alumina (Al₂O₃)

- Glass-Ceramic

- Aluminum Nitride (AIN)

- Others (Zirconia, Mullite)

By End-User

- Automotive Electronics

- Telecommunications

- Aerospace & Defense

- Industrial Electronics

- Medical Devices

- Consumer Electronics

By Application

- RF and Microwave Modules

- Sensors & Actuators

- Power Electronics Modules

- Multi-Chip Modules (MCMs)

- Other Electronic Packaging

By Manufacturing Process

- Tape Casting & Lamination

- Screen Printing

- Laser Structuring & Drilling

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6193

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/