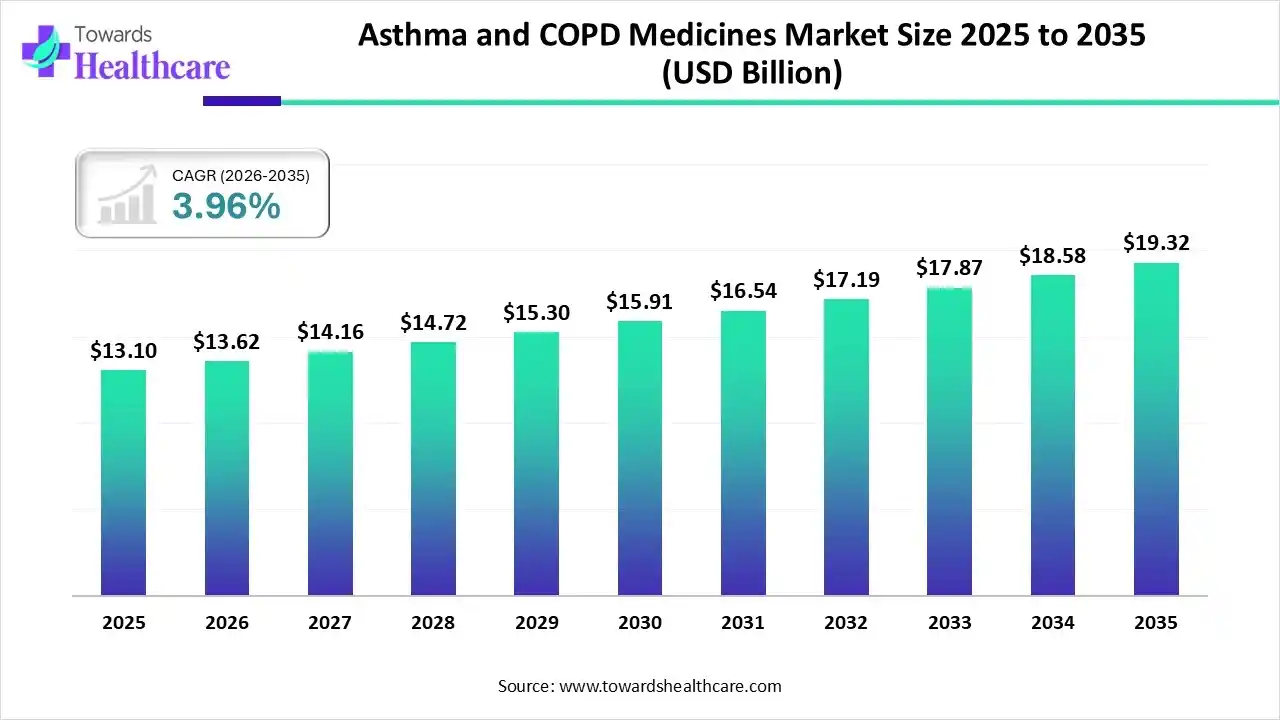

ottawa, Nov. 26, 2025 (GLOBE NEWSWIRE) — The global asthma and COPD medicines market size is calculated at USD 13.62 billion in 2026 and is expected to reach around USD 19.32 billion by 2034, growing at a CAGR of 3.96% for the forecasted period. The growth of the market is driven by an aging population, rising prevalence of respiratory diseases, and technological advancements which fuels the demand. The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6319 Key Takeaways Market Overview & Potential Asthma and COPD are common lung disorders caused by excessive airway constriction, making breathing difficult. Asthma is a respiratory disorder characterised by bronchial narrowing and difficult breathing. Shortness of breath, chest tightness or pain, and a wheezing sound while exhaling are all symptoms of asthma. The term “Chronic Obstructive Pulmonary Disease” (COPD) refers to a group of respiratory disorders that primarily include emphysema and chronic bronchitis. Asthma and COPD are diagnosed using X-ray imaging, a nitric oxide test, and a sputum examination. Bronchoconstriction is a common symptom of asthma and COPD and it can be treated with corticosteroids, anticholinergic drugs, and long-acting beta-agonists. Asthmatic patients may experience sudden bronchoconstriction, also known as an asthmatic attack. You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com What is the Growth Potential Responsible for The Growth of The Asthma and COPD Medicines Market? The asthma and COPD medicines market is driven by the high and increasing prevalence of these respiratory diseases globally, fueled by factors like pollution, smoking, and ageing populations. Other key drivers include technological advancements in drug delivery, a growing preference for convenient combination inhalers, and increased government and manufacturer efforts in raising awareness and funding research. What Are the Growing Trends Associated with the Asthma and COPD Medicines Market? Combination inhalers: There is a growing demand for combination inhalers that mix bronchodilators and corticosteroids to improve patient adherence and provide more effective, long-term treatment. Biologics: Biologic drugs are becoming more important for managing severe asthma and advanced COPD, as they target specific inflammatory pathways to provide a more personalised treatment approach. AI and digital health: Artificial intelligence (AI) is being increasingly used to analyse patient data, identify early warning signs of exacerbations, and support remote monitoring, which can improve clinical outcomes and reduce hospitalisations. Generic and biosimilar competition: The market is seeing increased competition from generic and biosimilar versions of established drugs, such as the launch of the first generic Symbicort inhalation aerosol, Breyna. Focus on patient access: Pharmaceutical companies are exploring ways to improve access and affordability for patients, with some initiatives focusing on making inhalers available at a lower monthly cost. Major Investment by Healthcare Organizations in 2025 What Is the Growing Challenge in the Asthma and COPD Medicines Market? Challenges for the asthma and COPD medicines market include underdiagnosis of COPD, the complexity and cost of developing and getting approval for new inhalable drug formulations, and issues with patient adherence, especially in low- and middle-income countries (LMICs). Other significant hurdles involve the high cost of advanced therapies like biologics, the need for specialised infrastructure, and patient factors such as incorrect inhaler technique, dexterity issues, and complex dosing schedules. Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting Regional Analysis How Did North America Dominate the Asthma and COPD Medicines Market in 2024? North America dominated the global market in 2024. The North American asthma and COPD drug market is large and growing, driven by factors like the high prevalence of respiratory diseases, increasing adoption of biologics and combination inhalers, and advancements in drug delivery systems. The market is dominated by North America, which held a significant share, supported by high diagnosis rates, a well-developed healthcare system, and strong awareness. What Made Europe Significantly Grow in The Asthma and COPD Medicines Market In 2024? Europe is expected to experience the fastest market growth during the forecast period. The European market for asthma and COPD medicines is a significant and growing sector, driven by factors like a high prevalence of respiratory diseases, an ageing population, and increased air pollution. Advanced healthcare systems and the growing adoption of combination and biologic therapies are also key drivers. Key countries in this market include the UK, Germany, France, and Italy, with Germany being the leader in bronchodilator drug research and development. Segmental Insights By disease, The asthma segment held the major share of the market in 2024. The asthma segment accounts for a significant share of the market due to the rising prevalence of allergic and environmental respiratory disorders, especially among children and young adults. Increased urban pollution, lifestyle changes, and early diagnosis through improved healthcare access are driving consistent demand. Long-term controller medications, inhalation therapies, and biologic drugs are expanding rapidly, supported by growing awareness programs and government initiatives promoting early respiratory disease management. The COPD segment is projected to expand rapidly in the market in the coming years. Chronic Obstructive Pulmonary Disease (COPD) represents a high-burden disease segment, especially in aging populations and among smokers. Growing exposure to occupational pollutants and indoor air pollution in developing regions is increasing disease incidence. The long-term treatment requirement, along with rising hospitalization rates, is driving strong demand for maintenance drugs, combination inhalers, and oxygen-linked medication regimens. This segment is expected to see sustained growth due to increasing life expectancy. Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership By medication class, The combination drugs segment held a dominant presence in the market in 2024. Combination drugs, which include two or more active ingredients such as LABA + ICS or LABA + LAMA, are gaining strong adoption in both asthma and COPD treatments. These drugs improve patient compliance by reducing dosing complexity and providing better symptom control. Their higher efficacy in moderate-to-severe cases has led to increased prescription rates. Growing physician preference, enhanced clinical outcomes, and longer prescription cycles support strong growth in this medication class worldwide. The inhaled corticosteroids segment will be the fastest-growing segment over the coming years. Inhaled corticosteroids remain the cornerstone for long-term asthma control and are also widely used in COPD management. They help reduce inflammation, decrease airway hyperresponsiveness, and prevent exacerbations. Increasing diagnosis of chronic respiratory diseases and growing awareness about preventive treatment strategies are boosting demand. Despite competition from biologics, ICS continues to dominate in cost-sensitive and primary healthcare settings due to high accessibility and affordability. By distribution channel, The retail pharmacies segment led the global market in 2024. Retail pharmacies remain the dominant distribution channel as they serve as the primary point of access for chronic respiratory patients. Their strong presence in both urban and semi-urban locations supports the wide availability of prescription medications. Increasing pharmacist-led consultations, insurance coverage, and accessibility to branded and generic inhalers are driving steady growth. This channel plays a critical role in long-term patient medication adherence and recurring sales. The online pharmacies segment is anticipated to grow at the highest CAGR in the market during the study period. Online pharmacies are witnessing rapid growth due to increasing digital healthcare adoption, home delivery services, and growing preference among urban populations. They offer convenience, price discounts, and repeat order systems for chronic conditions like asthma and COPD. The COVID-19 pandemic significantly accelerated this shift. With better regulatory frameworks and secure digital platforms, online pharmacies are expected to expand significantly, especially in developed and digitally advancing economies. Recent Developments Browse More Insights of Towards Healthcare: The global asthma and COPD drugs market size was calculated at USD 41.04 billion in 2024, to reach USD 43.1 billion in 2025 is expected to be worth USD 66.92 billion by 2034, expanding at a CAGR of 5.01% from 2024 to 2034. The global asthma treatment market size is set to grow from USD 28.55 billion in 2025 to USD 38.57 billion by 2034, with an expected CAGR of 3.4% over the forecast period from 2025 to 2034. The monoclonal antibody for asthma and COPD market size was valued at US$ 34.02 billion in 2025 and is projected to grow to 35.94 billion in 2026. Forecasts suggest it will reach approximately US$ 58.94 billion by 2035, registering a CAGR of 5.65% during the period. The global pulse oximeter market size is calculated at USD 3.56 billion in 2024, grow to USD 3.8 billion in 2025, and is projected to reach around USD 6.76 billion by 2034. The oncolytic virus CDMO services market size reached US$ 419.51 million in 2025 and is anticipate to increase to US$ 483.49 million in 2026. By 2035, the market is forecasted to achieve a value of around US$ 1734.41 million, growing at a CAGR of 15.25%. The modified antibody market size recorded US$ 3.10 billion in 2025, set to grow to US$ 3.38 billion in 2026 and projected to hit nearly US$ 7.36 billion by 2035, with a CAGR of 9.04% throughout the forecast timeline from 2026 to 2035. Asthma and COPD Medicines Market Key Players List Segments Covered in The Report By Diseases By Medication Class By Distribution Channel By Region Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6319 Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway. Access the Dashboard: https://www.towardshealthcare.com/access-dashboard About Us Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth. You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com Europe Region: +44 778 256 0738 North America Region: +1 8044 4193 44 APAC Region: +91 9356 9282 04 Web: https://www.towardshealthcare.com Our Trusted Data Partners Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Company

Investment

Lupin

In October 2025, Lupin invested $250 million, including research & development, infrastructure, and capital expenditures over five years. The new site will have the capacity to accommodate the production of more than 25 critical respiratory medicines, including lifesaving albuterol inhalers.

Merck

In October 2025, Merck's $10 billion acquisition of Verona Pharma strengthens its respiratory therapy offerings.

GSK's

In January 2024, GSK is paying $1.4 billion to acquire Aiolos Bio Inc., aiming to expand its severe asthma treatment capabilities.