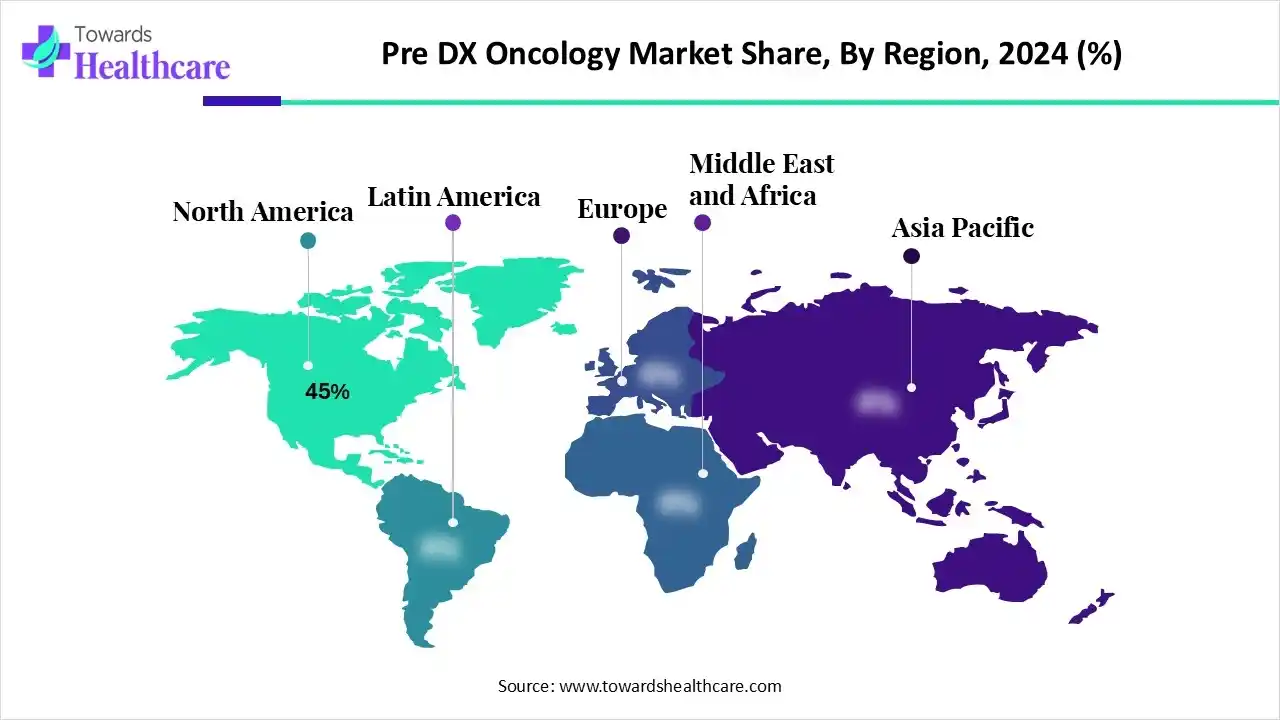

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) — The Pre-Dx oncology market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This market is surging because innovative, non-invasive early cancer detection technologies, especially liquid biopsy and multi-cancer early detection (MCED) tests are transforming cancer screening and enabling detection long before symptoms appear. The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6334 Key Takeaways: Market Overview: What are the factors driving the growth of the pre-diagnostic oncology (Pre-Dx) market? Pre-Dx oncology, or pre-diagnostic or early-detection oncology, encompasses diagnostic technologies and tests that identify cancers in the earliest stages of detection, often earlier than clinical symptoms are present or could be observed through imaging studies. The pre-Dx market is enabling risk stratification, cancer screening, and monitoring in asymptomatic populations leveraging many more accurate molecular approaches (e.g., liquid biopsy, next-generation sequencing [NGS], methylation profiling). Increased understanding of preventive health benefits, as well as growing investments in precision medicine, and favorable reimbursement policies are spurring adoption of these tests. Additionally, both clinical validation studies and regulatory advances support the accessibility and reliability of these tests. You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com Major Growth Drivers: What major drivers are spurring rapid growth in the pre-diagnostic oncology market? Key Drifts: What major trends impacting the pre-DX oncology landscape moving forward? Significant Challenge: The pre-DX oncology marketplace must contend with the regulatory and reimbursement hurdles. Many of the MCED tests and liquid biopsies are still in some sort of clinical validation/pilot mode. There are many reasons for this, not the least of which is the extensive amount of time and effort needed to get broad payer coverage and regulatory approval across markets, even when available studies show promising data. While the conversations on, and definitions of what constitutes appropriate evidence (clinical utility, cost-effectiveness) happens in different regions of the world, the landscape is fluid and lack of evidence pathway will just elongate the validation time. Plus, these advanced forms of molecular testing are relatively expensive, and these cases raise the question of affordability for low- and middle-income countries. Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting Regional Analysis: North America, with an emphasis on the United States, has been the flagship market for pre-DX oncology. The U.S. market benefits from a mature precision-medicine ecosystem, funding from venture capitalists and earlier regulatory pathways that support diagnostics innovation. Regional leaders in diagnostics have launched their flagship multi-cancer early detection (MCED) and minimal residual disease (MRD) products to be utilized in testing in the United States and have enjoyed rapid uptake from earlier adopters. Asia-Pacific has grown rapidly, with the fastest growth in pre-Dx oncology market. Increased cancer incidence and the natural expansion of clinical health care infrastructure and government providing a greater focus on preventive health agenda has fueled demand for testing and screening opportunities in this region. Countries such as China, Japan, India and Singapore continue to put national cancer screening programs in place, while local biotech companies continue to develop local MCED and liquid biopsy offerings. Regional partnerships between Asian biotechs and leading research institutions are emerging and will catalyze early detection tests that focus on off-the-shelf and are increasingly beneficial for early detection. Segmental Insights: By Test / Solution Type: Liquid biopsy tests commanded the lion's share of the market with their unmatched ability to detect early signs of tumors with a simple, quick and minimally invasive blood draw. Their utility across circulating tumor DNA, circulating tumor cells and other biomarkers makes them the ideal tool for early-stage cancer detection, treatment planning and monitoring. Coupled with high patient acceptance, rapid turnaround time and suitability for repeated testing, these tests can only strengthen further their dominant position. The multi-cancer early detection test (MCED) segment should be the fastest-growing segment during the forecast period. These tests offer a disruptive advantage through early detection of multiple cancer types using a single sample to identify molecular signals of cancer. With investment increasing in larger validation studies and expanding partnerships across healthcare networks, MCED-assays are quickly gaining momentum on a global scale. Especially as they have the potential to detect cancers for which we do not currently have screening tools, MCED's potential to prevent cancer at the population level is encouraging more researchers, clinicians and stakeholders to call it a breakthrough solution. Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership By Technology NGS was the quiet leader in the pre-Dx oncology market, given its exceptional sensitivity and scalability, as well as its ability to identify multiple genetic alterations in a simultaneous manner. This technology allows robust profiling of circulating tumor DNA and provides extensive insights into early molecular changes that are present long before symptoms emerge. Its widespread application and use case in MRD testing canister studies, liquid biopsy platforms, and MCED development makes it a primary foundational technology for advanced cancer detection. Methylation profiling will be the fastest growing technology because of its ability to identify epigenetic changes that occur very early in the tumor development process. Methylation profiling tests provide strong and universal cancer signals through methylation-based signatures, even when the concentration of tumor DNA is very low, which generates a strong signal of confidence for assessing cancer risk. Compared to mutation-based testing, methylation is among the most reliable indicators of early cancer diagnosis, and appears particularly effective for asymptomatic patients. By Sample Type Blood remains the leading sample type in 2024 as a result of its convenience, high yield of biomarkers, and established acceptance in clinical settings. There is consensus that plasma-based testing is the gold standard for liquid biopsy and MCED assays, as it provides reliable detection of circulating tumor DNA, extracellular vesicles, and protein markers. The minimally invasive procedure of a blood draw allows for routine screening, which is the ideal sample type for early cancer detection programs in large populations. Urine is quickly becoming the fastest-growing sample type due to superior patient comfort, ease of collection, and ability to be used for frequent screening. Urine, which contains many tumor-derived biomarkers (in both the cell-free DNA, metabolites, and exosomes), is a unique non-invasive sample type for early cancer detection. Urine sample types are generally applicable in cases of cancers of the urinary tract, but advancements in molecular profiling of urine samples have broadened their relevance to the gastrointestinal tract, gynecological cancer, and even systemic malignancies. By End-User: Because of their technical expertise, advanced technology, and established ongoing integration of molecular testing, clinical diagnostic laboratories will have the largest share of the pre-diagnostic oncology market. These laboratories are particularly well-equipped to manage complex workflows such as next generation sequencing (NGS), methylation assays, and multi-marker analysis. Therefore, these laboratories will remain centrally situated in the processing and interpretation of pre-diagnostic tests for cancer. Primary care clinics and population screening centers are likely to experience the fastest growth rate as we see a transition from facilitating the early detection of cancer in specialized oncology cancer settings to routine health checkups. The rapid growth of multi-cancer early detection (MCED) and liquid biopsy solutions will increasingly support primary care clinics and population screening centers with performing simple non-invasive early detection tests to asymptomatic patients. Their ubiquity, especially in local community health environments, significantly supports their capacity to reach large populations and advance accessibility to tests. Browse More Insights of Towards Healthcare: The global oncology drugs market size is estimated at US$ 204.39 billion in 2024, is projected to grow to US$ 217.18 billion in 2025, and is expected to reach around US$ 360.79 billion by 2034. The market is projected to expand at a CAGR of 6.29% between 2025 and 2034. The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034. The global oncology biomarker market size is calculated at US$ 34.16 billion in 2024, grew to US$ 38.62 billion in 2025, and is projected to reach around US$ 113.54 billion by 2034. The market is expanding at a CAGR of 12.73% between 2025 and 2034. The global oncology devices market size is calculated at US$ 150.35 billion in 2024, grew to US$ 177.17 billion in 2025, and is projected to reach around US$ 776.3 billion by 2034. The market is expanding at a CAGR of 17.84% between 2025 and 2034. The global oncology automation market size is calculated at US$ 2.82 billion in 2024, grew to US$ 3.12 billion in 2025, and is projected to reach around US$ 7.77 billion by 2034. The market is expanding at a CAGR of 10.68% between 2025 and 2034. The global oncology NGS market size was calculated at US$ 508.95 million in 2024, grew to US$ 589.01 million in 2025, and is projected to reach around US$ 2,193.49 million by 2034. The market is expanding at a CAGR of 15.73% between 2024 and 2034. The global oncology clinical trial market size recorded US$ 13.64 billion in 2024, set to grow to US$ 14.36 billion in 2025 and projected to hit nearly US$ 22.85 billion by 2034, with a CAGR of 5.30% throughout the forecast timeline. The global oncology molecular diagnostics market size is calculated at USD 3.11 billion in 2024, grew to USD 3.48 billion in 2025, and is projected to reach around USD 9.76 billion by 2034. The market is expanding at a CAGR of 12.13% between 2025 and 2034. The global oncology companion diagnostic market size is calculated at USD 5.24 in 2024, grew to USD 5.7 billion in 2025, and is projected to reach around USD 12.07 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034. The global oncology market size is calculated at US$ 225.05 billion in 2024, grew to US$ 251.01 billion in 2025, and is projected to reach around US$ 600.97 billion by 2034. The market is expanding at a CAGR of 11.54% between 2025 and 2034. The global oncology biosimilars market size is calculated at US$ 6.7 billion in 2024, grew to US$ 7.94 billion in 2025, and is projected to reach around US$ 36.23 billion by 2034. The market is expanding at a CAGR of 18.47% between 2025 and 2034. The global AI in oncology market size is estimated at US$ 1.95 billion in 2024 and is projected to grow to US$ 2.52 billion in 2025, reaching around US$ 25.02 billion by 2034. The market is projected to expand at a CAGR of 29.36% between 2025 and 2034. Recent Developments: In May 2025, Inocras revealed that its MRDVision platform received CLIA validation, significantly improving its clinical readiness. The platform combines Inocras' CancerVision whole-genome sequencing (WGS) and p ppmSeq from Ultima Genomics for ultra-high sensitivity. PR Pre-Dx Oncology Market Key Players List: Segments Covered in the Report By Test/Solution Type  By Technology By Sample Type By End-User By Region Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6334 Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway. Access the Dashboard: https://www.towardshealthcare.com/access-dashboard About Us Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth. You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com Europe Region: +44 778 256 0738 North America Region: +1 8044 4193 44 APAC Region: +91 9356 9282 04 Web: https://www.towardshealthcare.com Our Trusted Data Partners Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest