Ottawa, Sept. 20, 2024 (GLOBE NEWSWIRE) — The global bioplastic packaging market size was valued at USD 17.99 billion in 2023 and is predicted to increase from USD 21.09 billion in 2024 to USD 87.98 billion by 2033, a study published by Towards Packaging a sister firm of Precedence Statistics.

Key Takeaways: Leading Factors of the Bioplastic Packaging Market

Key Takeaways: Leading Factors of the Bioplastic Packaging Market

- Use of renewable resources due to growing sustainable demand is the major factor that drives the market.

- Eco-friendly alternatives perceive growth in North America due to growing environmental concerns.

- Food and beverage industry is the dominating sector in the market due to the increasing consumption of packed food.

- Limited infrastructure for bioplastic processing is an unceasing challenge for the market.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5215

Bioplastic Packaging Market: At a Glance

The bioplastic packaging market revolves around adoption renewable packaging which can be used multiple times and which is an alternative to the fossil fuel-derived plastics. Along with this, resource depletion, reduction of carbon footprint and material waste are the leading objectives of the market. The demand for sustainable packaging solution and the increasing plastic waste has increased the demand of the market.

The bio-degradable feature attributes to the reusable function of bioplastic packaging. The consumer demand for sustainable packaging has also increased the demand of the bioplastic packaging, given the reason it provides resistance and prevents denting as well. The bioplastic material tends to degrade easily which also reduces landfill waste.

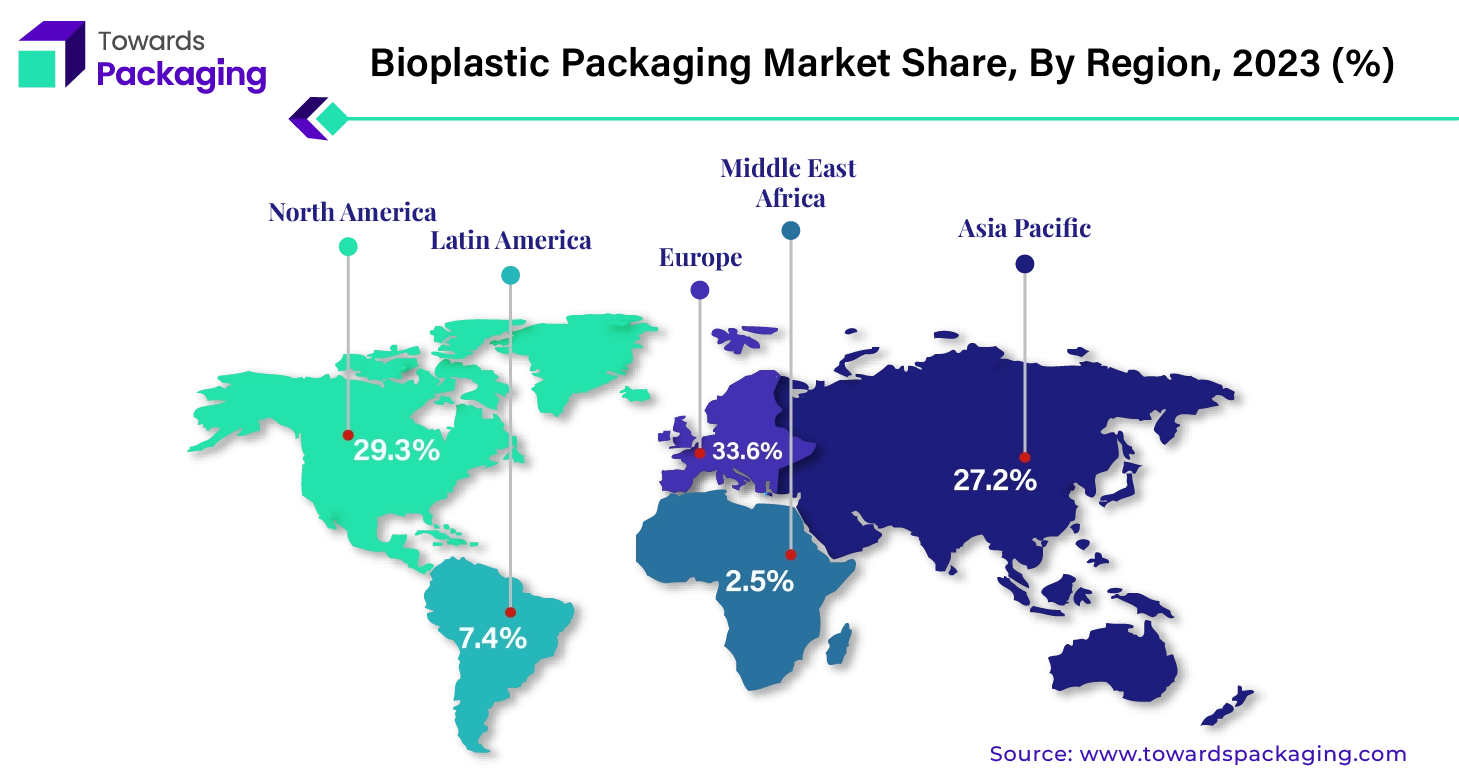

Regional Insights

Europe thrives with its vision of sustainable packaging demand

Europe is the dominating region in bioplastic packaging market. The sustainability focus of Europeans has sustained the environment and the alternative packaging solutions have increased the popularity of eco-friendly packaging. The European vision of preserving sustainability is also about turning packaging materials into recyclable or reusable material by 2030 and this has increased exploration of alternative materials, design strategies and mostly importantly waste management system.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Europe targets to reduce unnecessary packaging by 10% in 2035 and by 15% in 2040. The demand for bioplastic as an alternative increase as Europe has strict regulations against plastic usage which aims to reduce the utilization of single use-plastic to prevent environmental hazards, especially, in marine environment and human health. In addition, European Union also aims at promoting circular economy and innovative sustainable packaging solutions with specific targets which are 77% separate collection target for plastic bottles by 2025 and will be increased to 90% by 2029. Furthermore, 25% of recycled plastic will be incorporated in PET beverage bottles from 2025 and will be increased by 30% in all plastic beverage bottles from 2030.

- In January 2024, European retailers were relived to watch the inflation slow down as it had decreased the consumer rate by 0.1%. Despite the increasing rates and fleeting number of consumers, shopkeepers were committed to the sustainable drive. The UK consumer survey stated that 62% believed that high prices are pulling them back from being sustainable and 52% said that sustainable alternatives should have affordable prices.

North America is a steady region for the bioplastic packaging market due to its sustainable packaging demand which is also the growing consumer requirement. The impact of conventional plastic adds to the ocean litter hazard and as an alternative to reduce carbon print, sustainable solutions are being adopted. Although the American consumers worry more about convenience, price and quality given the increased purchasing rates and the tax-paying lifestyle, 40% of consumers pay more attention to the provided sustainable packaging.

The use of compostable packaging allows circular economy in the US and the companies are innovating new alternatives to support the sustainable drive and to increase their profit margin. According to U.S Environmental Protection Agency, reuse of plastic materials circulates the economy and reduces environmental impact if the material is in constant use instead of manufacturing new one. According to PEW’s research, reuse of plastics can accomplish 30% of reduction, substitution efforts by 17%, improved innovations in recycling by 20% and proper management at end-of-life can achieve a 23% reduction of plastic pollution in the environment.

If there’s anything you’d like to ask, feel free to get in touch with us @ sales@towardspackaging.com

- In November 2023, Knox County, a startup had announced the of AgroRenew LLC and had also planned to build $83 million processing facility which was designed to convert food waste into eco-friendly bioplastics. The company had expected to establish itself in early 2024 and had aimed to produce 150,000 tons of bioplastic annually.

Asia-Pacific is the fastest growing region in bioplastic packaging market with its large population as a contributor and its rapidly increasing industrial sector. The packed food consumption and the boom of e-commerce also gave preference to sustainable packaging due to strict regulations and subsidies provided to promote the compostable packaging. According to Department of Biotechnology, Ministry of Science & Technology, Government of India, the usage of single-use plastic (SUPs) was intended to stop by December 2022. The policy of Government of India (GOI) was changed to promote the development of biodegradable plastic products instead of single-use plastic.

The method used for testing substances should be able to demonstrate biodegradability as per national and international standards and should also be interim approved and receive provisional certification of biodegradability. China having a large industrial production had signed the Paris agreement to reduce carbon footprint and oil dependency as well.

Although the National Development and Reform Commission and Ministry of Ecology and Environment had plans to reduce plastic garbage, the limited infrastructure for recycling and manufacturing biodegradable plastic came as a challenge. The Chinese Government had implemented ban on plastic recycled and prohibition of non-biodegradable single-use plastic.

- In February 2024, Balrampur Chini Mills Limited (BCML), which is a leading integrated sugar mill Kolkata-based company had announced a project with integration of â?¹2,000 crore and it was going be the first industrial bioplastic plant in India. The company also stated that it had well-aligned sustainable goals to combat the climate change.

Driver

Government regulations drive the bioplastic packaging market

The major driving factor is the environmental regulations due to increasing plastic waste production which is a problem for the eco-system. The growing concern for climate change, increasing plastic pollution and landfill waste has led to the utilization of bioplastic packaging which is reliable and bio-degradable. The government policies promote the use of biodegradable and bioplastic packaging as it reduces the use of plastic and also its generation.

The government initiatives will increase sales, improve brand perception and also contribute to cost-savings. According to the Consumer Brands Association, FMCG manufacturers have adopted 100% recycled packaging by 2030.

Restraint

Limited infrastructure and higher costs of materials hinder the market growth

The leading challenges which hinder the growth of bioplastic packaging market is high material costs and limited infrastructure. The manufacturing process and raw materials can affect the production of biodegradable packaging. The limited infrastructure also poses as a challenge for the manufacturing and recycling processes.

Opportunity

Integration of Artificial Intelligence

The technological advancement offers new trends which are development of raw materials like algae, mushroom mycelium, and agricultural waste which poses as an emerging alternative. The major factor which technology can contribute is in biodegradability which will enhance the decomposing process of plastic and it also offers upcoming features like the antimicrobial properties which are significant for medical applications, use of UV resistance for outdoor use, and improved barrier properties for food packaging. Collaboration among leading industries can create more innovate and ground-breaking effective solutions for the bioplastic packaging market.

Top Companies Leading the Bioplastic Packaging Market

- Amcor plc

- Novamont S.p.A

- NatureWorks, LLC

- Coveris

- Sealed Air

- Alpha Packaging

- Constantia Flexibles Group GmbH

- Mondi plc

- Truegreen

- Transcontinental Inc.

- ALPLA

- Envigreen

- Nature’s Bio Plastic

- Raepak Ltd.

- Tipa-corp Ltd.

- Treemera GmbH

- Element Packaging Ltd

- Alpagro Packaging

Recent Development

| Company | Balrampur Sugar Mills Firm |

| Headquarters | Uttar Pradesh, India |

| Recent Development | In June 2024, the Uttar Pradesh Government had announced to build a bioplastic park in the Lakhimpur Kheri district which aimed at increasing local economy. The bioplastic park was designed to promotes the usage of bioplastic plastics. |

| Company | Praj Industries |

| Headquarters | Maharashtra |

| Recent Development | In February 2024, Praj Industries had announced that its pilot plant for polylactic acid (PLA) will be completed by April 2024. The company will develop renewable chemicals which is a part of R&D push. The Union Budget had also contemplated a policy for bio-manufacturing and bio foundry. |

Segmental Insights

By Type

The flexible segment is the dominating segment in the bioplastic packaging market. It is dominating due to its properties which are conserving resources and contributing to the sustainability. The flexible segment provides convenience, strong protection and reduces wastage of food and can also resist denting and breakage. Apart from this, it also increases shelf life of the products and the packaging is in demand due to its features like multi-layer construction and eco-friendly packaging solution. Lightness, safety and resistance are the factors which increase the demand of bioplastic packaging.

The rigid segment is the fastest growing segment in the bioplastic packaging market. It will dominate the market due to its properties which are providing protection, resistance and preserving product quality. The rigid segment offers a durable and reliable packaging which makes it preferred among the consumers. Customization and exceptional product protection are the essential features of the rigid segment.

By Application Type

The food and beverage segment are the dominating segment in the bioplastic packaging market. The segment dominates due extended shelf life provided to the food products and long-lasting convenience and visibility. The bioplastic packaging depends upon the type of packaging it provides which provides string barrier against external elements like oxygen, moisture and prevents food spoilage as well. Th global consumption of containers like boxes, bags, jars and pouches has increased the bioplastic packaging demand in food sector.

The consumer and goods segment are the fastest growing segment in the bioplastic films packaging market. The segment dominates due to sealed packaging and robust protection by bioplastic packaging.

More Insights of Towards Packaging

- The global end-of-line packaging market size is estimated to reach USD 9.50 billion by 2033, up from USD 6.14 billion in 2023, at a compound annual growth rate (CAGR) of 4.60% from 2024 to 2033.

- The global surgical instruments packaging market size reached US$ 24.8 billion in 2023 and is projected to hit around US$ 49.1 billion by 2034, expanding at a CAGR of 6.55% during the forecast period from 2024 to 2033.

- The global cannabis packaging market size reached USD 2.32 billion in 2023 and is projected to hit around USD 22.10 billion by 2034, expanding at a CAGR of 22.74% during the forecast period from 2024 to 2034.

- The global clinical trial packaging market size reached USD 2.95 billion in 2023 and is projected to hit around USD 9.12 billion by 2034, expanding at a CAGR of 10.80% during the forecast period from 2024 to 2033.

- The global panel level packaging market size is estimated to reach USD 11.13 billion by 2033, up from USD 0.43 billion in 2023, at a compound annual growth rate (CAGR) of 38.60% from 2024 to 2033.

- The global hazardous goods packaging market size reached US$ 11.50 billion in 2023 and is projected to hit around US$ 21.38 billion by 2034, expanding at a CAGR of 5.80% during the forecast period from 2024 to 2033.

- The global rigid tray market size reached US$ 11.65 billion in 2024 and is projected to hit around US$ 14.72 billion by 2034, expanding at a CAGR of 2.37% during the forecast period from 2024 to 2034.

- The global cider packaging market size is estimated to reach USD 7.05 billion by 2033, up from USD 4.08 billion in 2023, at a compound annual growth rate (CAGR) of 5.77% from 2024 to 2033.

- The global boxboard packaging market size is estimated to reach USD 117.61 billion by 2033, up from USD 65.73 billion in 2023, at a compound annual growth rate (CAGR) of 6.12% from 2024 to 2033.

- The global corrugated plastic tray market size reached US$ 665.47 million in 2023 and is projected to hit around US$ 1190.73 million by 2034, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2034.

Bioplastic Packaging Market Segment

By Material

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-biodegradable

- Bio Polyethylene

- Bio Polyethylene Terephthalate

- Bio Polyamide

- Others

By Type

- Flexible

- Rigid

By Application

- Food & Beverages

- Consumer Goods

- Cosmetic & Personal Care

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

View Bioplastic Packaging Market Full TOC: https://www.towardspackaging.com/table-of-content/bioplastic-packaging-market-sizing

Buy Premium Global Insight @ https://www.towardspackaging.com/price/5215

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

COMTEX_457966871/2471/2024-09-20T11:05:07